Headlines

Tinubu Suspends Key Tax Measures To Ease Hardship

To boost manufacturing and ease of doing business, President Bola Ahmed Tinubu yesterday, July 6th signed four executive orders (EOs).

The motive of the EOs, which suspended some key taxes, is to boost economic activities and reduce hardship, presidential advisers said.

According to them, the need to respect the international best practice of giving a 90-day window to investors before new taxes are introduced also brought about the EOs.

The officials explained that the Federal Government will not raise taxes until after robust consultation with stakeholders.

Special Adviser to the President on Special Duties, Communication and Strategy, Mr Dele Alake, broke down the issues around the new EOs at Aso Villa, Abuja.

He was supported by other members of the Presidential Revenue Team.

Others on the team were Special Adviser to the President on Revenue Mr Zacc Adedeji; a member of the Presidential Advisory Council on Finance and other Related Matters, Ms Doris Aniettie; and an official from the Office of the Chief of Staff to the President, Adenike Laoye.

According to the team, the move became necessary as a response to the need for clarity and adequate notice for tax adjustments, as specified in the 2017 National Tax Policy.

According to Alake, the first executive order is The Finance Act (Effective Date Variation) Order, 2023, which has now deferred the commencement date of the changes contained in the Act from May 23, 2023, to September 1, 2023, to ensure adherence to the 90 days minimum advance notice for tax changes as contained in the 2017 National Tax Policy.

The second order is The Customs, Excise Tariff (Variation) Amendment Order, 2023, which has also shifted the commencement date of the tax changes from March 27, 2023, to August 1, 2023, and also in line with the National Tax Policy.

Thirdly, Alake said the President had given an Order suspending the five per cent excise tax on telecommunication services as well as the excise duties escalation on locally manufactured products.

Fourthly, he said the President has ordered the suspension of the newly introduced Green Tax by way of excise tax on Single-Use Plastics, including containers and bottles.

He added that the President had ordered the suspension of the import tax adjustment levy on certain vehicles.

According to him, President Tinubu intends to listen to the concerns of the Nigerian people and alleviate the negative impact of the tax adjustments rather than exacerbate the challenges faced by citizens.

“The President wishes to reiterate his commitment to reviewing complaints about multiple taxation, local and anti-business inhibitions.

“The Federal Government sees business owners, local and foreign investors as critical engines in its focus on achieving higher GDP growth and an appreciable reduction in the unemployment rate through job creation.

“The government will, therefore, continue to give requisite stimulus by way of friendly policies to allow businesses to flourish in the country.

“President Tinubu wishes to assure Nigerians by whose mandate he is in power that there will not be further tax raise without robust and wide consultations undertaken within the context of a coherent fiscal policy framework,” Alake added.

According to him, some of the problems identified with the tax changes include the 2017 National Tax Policy approved by the Muhammadu Buhari Administration, prescribing a minimum of 90 days’ notice from the government to tax-payers before any tax changes can take effect.

“This global practice is done to give taxpayers and businesses reasonable time to adjust to the new tax regime.

“However, both the Finance Act 2023 and the Customs, Excise Tariff Order 2023 did not give the required minimum notice period, thus putting businesses in violation of the new tax regime even before the changes were gazetted.

“As a result of this, many of the affected businesses are already contending with the rising costs, falling margins and capacity underutilisation due to the various macroeconomic headwinds as well as the impact of the Naira redesign policy,” he said.

The presidential spokesman also noted that the excise tax increases on tobacco products and alcoholic beverages from 2022 to 2024, which had already been approved, are also being implemented.

Alake maintained that a further escalation of the approved rates by the current administration presents an image of policy inconsistency and creates an atmosphere of uncertainty for businesses operating in Nigeria.

“The excise tax of five per cent on telecommunication services has generated heated controversy.

“There is also a lack of clarity regarding the status of this tax, just as players in the sector also complain about the imposition of multiple taxes on their operations.

“We have also seen that the Green Taxes, including the Single Use Plastics tax and the Import Adjustment Levy on certain categories of vehicles, require more consultation and a holistic approach to the country’s net zero plan in a manner that does not impact the economy negatively.”

In his inauguration speech, President Tinubu promised to address business unfriendly fiscal policy measures and multiplicity of taxes.

Alake explained that it was in fidelity to the pledge to put Nigerians at the centre of government policies that President Tinubu signed the executive orders.

On whether the President’s action would affect the Petroleum Tax and if new taxes would be introduced, the Special Adviser on Revenue, Mr Adedeji, stressed that the President intended to lighten tax burdens, harmonise and manage already existing taxes in the best interest of Nigerians.

He said: “As you rightly said that there’s a plan or possibly proposal for Petroleum Tax, if you look at the current price templates, that has already been included, so this suspension has nothing to do with that.

“So the pricing structure that you have for PMS today, all those have been included, there’s no new taxes that we’re bringing in.

“As my colleague has said, one of the key focuses of this administration is to harmonise our taxes, the way we collect them.

“Mr President wants to simplify and make it friendly to business, the way we operate taxes in Nigeria.

“When we talk about revenue management, it’s not only in tax collection. The starting point is our economic policy because our aim is not to tax poverty. Our aim is not to tax production.

“We aim to increase our productive activities, capacity to produce, then we can tax our consumption and that is the direction of our economic planning and then we want to increase the trust that we have in the government.

“If you have observed what has happened in the last month that we’ve been here, we’ve kept our word.

“Part of what we are doing today (with the EOs) is just to increase this trust that we’re here to do what’s best for the country.

“We have a robust plan to improve our collection and compliance management because that is what is needed.

“So, we’re not going to impose new taxes. We’ll improve the collection, management and efficient use of those resources.

“That is the pledge and promise of Mr. President, which we’re here to make sure comes to reality.”

The post Tinubu Suspends Key Tax Measures To Ease Hardship appeared first on Jomog.

Education

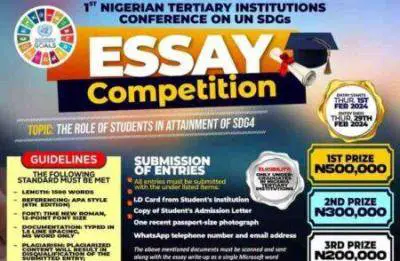

1ST NIGERIAN TERTIARY INSTITUTIONS CONFERENCE ON UN SUSTAINABLE DEVELOPMENT GOALS (SDGS) ESSAY COMPETITION

Competition Overview:

The SDG Youth Essay Competition offers a grand prize of N1 million for the top three winners, along with free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Competition Requirements:

1. Eligibility:

– Open exclusively to undergraduates in Nigerian tertiary institutions.

2. Entry Guidelines:

– Topic:The Role of Students in Attainment of SDG4

– length: Essays should be 1500 words.

– Entry Period: Thursday, February 1, 2024 – Thursday, February 29, 2024

– Referencing: APA Style (6th Edition).

– Font: Times New Roman, 12-point font size.

– Documentation: Typed in 1.5 line spacing, MS Word format only.

– Plagiarism: Only original content is accepted; plagiarized entries will be disqualified.

Benefits:

– Prizes:

– 1st Prize: N500,000

– 2nd Prize: N300,000

– 3rd Prize: N200,000

– Winners will also receive free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Required Documents:

– Student’s Institution ID Card

– Copy of Student’s Admission Letter

– One recent passport-size photograph

– WhatsApp telephone number and email address

Application Procedure:

– All entries and submissions (essay and required documents) should be scanned and sent to nigeriaessay@sdgyouth.org before the deadline.

For Further Inquiries:

– Call: 08068931151, 08133846739, 07067772964

– Email: nigeriaessay@sdgyouth.org

Deadline: February 29th, 2024

Don’t miss this opportunity to contribute to achieving SDG4 and win exciting prizes. Submit your entry and required documents before the deadline. For any inquiries, feel free to contact them via phone or email.

Education

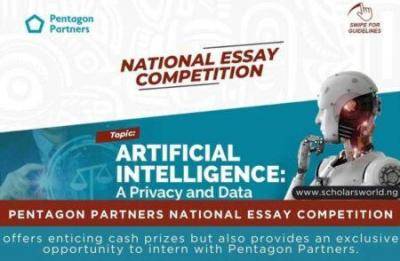

PENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

Competition Overview:

The National Essay Competition invites undergraduate law students to showcase their expertise and contribute to the discourse on AI, privacy, and data protection. In addition to cash prizes, participants have the chance to intern with Pentagon Partners, gaining valuable hands-on experience.

Competition Requirements:

1. Eligibility:

– The competition is open to 400-level and 500-level undergraduate law students in Nigerian universities.

2. Essay Requirements:

– Length: Essays should not exceed 1500 words.

– Format: Double spaced, 12pt Times New Roman font.

– References: OSCOLA format for citations with 10pt font size for footnotes and endnotes.

– Submission Format: Essays must be submitted in PDF format.

– Entrant Details: Include full names, school, level, phone number, and email address in both the body of the email and on the last page of the essay.

– Single Entry: Each entrant is allowed only one submission.

– Originality: Plagiarism will result in automatic disqualification.

Competition Benefits and Timeline:

1. Prizes:

– Winner: N200,000

– 1st Runner Up: N150,000

– 2nd Runner Up: N100,000

2. Internship Opportunity:

– In addition to cash prizes, winners have the exclusive opportunity to intern with Pentagon Partners, enhancing their career prospects.

Application Procedure:

– Interested participants should submit their essays to essay@pentagonpartnerslp.com during the submission period.

– The subject of the email should be the Essay topic

For additional information and updates, visit www.pentagonpartnerslp.com.

Deadline: March 22nd, 2024

Don’t miss this chance to showcase your legal expertise, contribute to important discussions on AI and law, and vie for enticing cash prizes. Pentagon Partners looks forward to receiving your submissions.

Education

SYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

Purpose:

Inaugurated in 2020, the CDEC is part of SystemSpecs’ Corporate Social Responsibility (CSR) commitment to promoting capacity development in the Nigerian ICT industry. By encouraging young Nigerians to tackle everyday issues, the competition contributes to intellectual growth and societal progress.

Topic:

The theme for the 2024 competition is “Protecting the Nigerian Child from the Dangers of Online Technology.” Participants are tasked with exploring strategies to safeguard children in an increasingly digital world.

Eligibility:

– Open to primary and secondary school students in Nigeria aged 9 to 16.

– Junior category (ages 9 to 12) essays must not exceed 1,000 words.

– Senior category (ages 13 to 16) essays must not exceed 1,500 words.

Prizes:

– Winners will receive generous rewards, including a high-capacity laptop, premium headphones, a portable laptop stand, a smart wristwatch, and one year of internet data, among other items.

– Consolation prizes will be awarded to other participants.

Application Process:

– Interested candidates should access the application page

– Essays must be written in English and reflect original thought.

– Each participant is limited to one entry.

– Entries must be endorsed by an accredited school official, parent, or legal guardian.

– Deadline for submissions is April 12, 2024.

Submission Guidelines:

– All submissions must be in PDF format and include the student’s name, home and school addresses, email address, and contact phone number.

– Double entries will result in automatic disqualification.

– Submissions must be received by March 15, 2024, at 5:00 p.m.

Notification of Winners:

– Successful students and schools will be contacted in the second quarter of the year.

– Updates on winners will be announced on @nercng social media platforms.

The SystemSpecs Children’s Day Essay Competition offers a unique opportunity for Nigerian students to demonstrate their creativity and problem-solving skills. By addressing the theme of online child protection, participants contribute to building a safer and more secure digital environment for all. We encourage eligible students to seize this opportunity and showcase their talent and ingenuity.

-

Education8 months ago

Education8 months agoSYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

-

News2 years ago

News2 years agoFull Text of President Bola Tinubu’s Inauguration Speech on May 29, 2023

-

CELEBRITY NEWS2 years ago

CELEBRITY NEWS2 years ago“E no balance”-Netizens react as Bobrisky shows off new shape days after surgery

-

entertainment11 months ago

entertainment11 months agoAuthorities Arrest Six in Connection with Murder of South African Rapper AKA [VIDEO]

-

Education7 months ago

Education7 months agoPENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

-

Education8 months ago

Education8 months agoUNIVERSITY OF LAGOS (UNILAG) ANNOUNCE SALES OF SANDWICH ADMISSION FORM

-

Headlines2 years ago

FULL TEXT: Tinubu Addresses 78th UN General Assembly

-

CELEBRITY NEWS2 years ago

CELEBRITY NEWS2 years ago“I no wan hear anything again o” – Esther Nwachukwu reacts as Chacha Eke and hubby, Austin lock lips in new video