Headlines

Naira Slump: CBN Clamps Down On Speculators, Restricts Diaspora Remittances

Following the tumbling of the naira at the parallel market in recent times, the Central Bank of Nigeria has started introducing foreign exchange intervention measures aimed at clamping down on currency speculators in the foreign exchange markets.

Acting Governor of the CBN, Folashodun Shonubi, made the disclosure to State House correspondents on Monday at the Presidential Villa after briefing President Bola Tinubu on what the bank was doing to halt the slide of the naira.

He said Tinubu expressed his concern over the effects of the recent developments in the foreign exchange market, particularly on average citizens.

According to Shonubi, the volatility of the naira in the parallel market is not solely driven by economic factors, but also speculative demand.

The apex bank governor said while he would not disclose specific details of the proposed intervention measures, he warned speculators that the proposed measures could potentially lead to significant losses for them.

He said the primary purpose of his presence at the Presidential Villa was to reassure the President that the CBN was taking decisive action to address the concerns raised.

He expressed confidence that the measures being implemented would yield positive outcomes within a few days.

According to him, the CBN’s ultimate goal is to create an efficient and reasonable operating environment that minimises the negative impacts on the average Nigerian’s life.

He said, “Mr President is very concerned about some of the goings on in the foreign exchange market. One of the things we discussed is what could be done to stabilise and what could be done to improve the liquidity in the market and also the goings on in the various other markets, including the parallel market.

“He’s concerned about its impact on the average person, since, unfortunately a lot of activities that we do, which are purely local, are still referenced to exchange rates in the parallel market.

“We’ve discussed and I’ve shared with him what we’re doing to improve supply. If you look at the official market, you’ll find that that market has been fairly stable and the spreads of the difference have not fluctuated as much.”

He added, “We do not believe that the changes going on in the parallel market are driven by pure economic demand and supply, but are touched by speculative demand from people.

“Some of the plans and strategies, which I’m not at liberty to share with you, means sooner rather than later, the speculators should be careful because we believe the things we’re doing, when they come to fruition, may result in significant losses to them.

“But my presence here is more about the concerns the President has and his needs to know that we are doing something about it, assurances of which I have given him totally.

“So I hope this helps. We are looking at it and we’re doing things which will significantly impact the market in a few days time and we will all see it. The intention is to ensure the environment operates at a level that’s more efficient, but also that is also very reasonable and does not have a negative impact to the best that we can on the lives of the average person.”

Meanwhile, findings by The PUNCH show the central bank has started introducing some measures aimed at reducing pressure on the naira at the parallel market.

The CBN has issued a circular to all authorised dealers, international money transfer operators and the general public.

The circular was signed by the Director, Trade and Exchange Department, CBN, Ozoemena Nnaji.

In the circular dated August 9, 2023, the CBN placed limits on the exchange rate for naira payout of Diaspora remittances.

The CBN directed that the naira payment option for proceeds of Diaspora remittances should be made within a limit of -2.5 per cent to +2.5 per cent of the previous day’s average rate on the Investors’ and Exporters’ window.

The circular read, “Further to the circular referenced TED/FEM/PUB/FPC/001/004 dated July 10, 2023 and the meetings held with all banks and IMTOS, the Central Bank of Nigeria hereby announces an allowable limit of -2.5% to +2.5% of the Investors’ and Exporters’ window average rate of the previous day as the anchor rate for the naira payout option.

“Accordingly, all banks and International Money Transfer Operators are required to adhere to the stipulated limits. Please note and ensure strict compliance.”

Shonubi had last week said the diversion of Diaspora remittances to the parallel market was putting pressure on the local currency.

At the end of the last Monetary Policy Committee meeting, the acting CBN governor said the apex bank was working towards making the forex market more efficient and effective in the face of high demand for dollars.

Regarding the CBN’s responsibility in the market, Shonubi said, “The role of the central bank is to intervene and keep the market at a fairly stable level.”

With the arbitrage gap between the I&E Fx window and the parallel market widening to about N100 due to foreign exchange shortage shortage, the Economic Intelligence Unit recently predicted that the CBN will revert to “heavier management of the exchange rate in late 2023 to tame rapid price rises.”

Naira faces free-fall

Meanwhile, the naira has lost an essential source of support after the central bank’s long-delayed financial statements revealed that effective foreign-exchange reserves at its disposal were much lower than previously disclosed according to Bloomberg report.

The accounts published on Friday showed a previously undisclosed $7.5bn in transactions with JP Morgan Chase & Co and Goldman Sachs Group Inc.

In addition, it detailed an exposure in foreign-currency forward contracts of almost $7bn. The central bank also showed it vastly exceeded the limit placed on its lending to the government.

The local currency has already been plunging since the CBN allowed it to trade more freely in June.

The issue with the net reserves shown in the report last week means the central bank’s capacity to defend the naira is limited, the Chief Executive of Lagos-based CFG Advisory, Adetilewa Adebajo, said.

“Given the state of the CBN balance sheet and the fact that the Naira is already at 945 to the dollar on the parallel market, the road to 1,000 looks unhindered,” Adebajo said.

Unauthorised market

The move to a more liberal exchange system was designed to remove obstacles which had deterred foreign investors, but the expected jump in inflows has been slow in coming.

The CBN has also been unable to increase supply significantly through its interventions in the official window where the currency is traded, driving demand to an unauthorised market where the dollar is about 18 per cent more expensive.

Goldman and JP Morgan declined to comment. Officials at the central bank did not respond to requests for comment.

The recently released accounts raise concerns about the sufficiency of the nation’s external reserves to support liquidity in the foreign exchange market, the director, CEEMEA fixed income at BancTrust & Co, Ayodeji Dawodu, said.

“The local currency will remain under pressure in the coming months unless the central bank increases its intervention in the market and/or incentivises foreign portfolio inflows,” Dawodu said.

Real rates

To be sure, the bank loans revealed in the statement were “received in exchange for foreign currency securities pledged by the central bank and were intended to support its liquidity position,” Dawodu said in a report.

While the central bank has reported more than $30bn in reserves as of the end of 2022, subtracting obligations revealed in the report means it has a net reserve of just $17bn, RMB Bank said in a note on Monday.

Nigeria dollar bonds have come under pressure since the revelations about the central bank reserves. The note maturing in 2051 has fallen about four cents in the past two sessions to 73 cents on the dollar as of 2:53 pm in London, the lowest in a month.

To boost inflows, the central will have to raise interest rates and consider an International Monetary Fund programme, Head of Macro Strategy at Frontier Investment Management Partners, Charles Robertson, said.

“Nigeria’s interest rates remain deeply negative in real terms – the most negative in Africa among all the countries we follow, and second only to Argentina in the world,” Robertson said.

Seven-month zero earnings on crude oil sales worsen Nigeria’s forex crisis

Zero earning

Meanwhile, Nigeria has earned nothing from the crude oil sales for about seven months, and this has worsened the foreign exchange crisis in the country, The PUNCH has learnt.

Data from the quarterly statistical bulletin of the Central Bank of Nigeria showed that the last time Nigeria had a record for earnings from crude oil sales was in August 2022.

This means that Nigeria has earned nothing from the sales of crude oil for about seven months from September 2022 to March 2023, according to the CBN data.

Amid the zero revenue from crude oil sales, Nigeria has been suffering declining oil production.

The Organisation of the Petroleum Exporting Countries recently said that Nigeria’s oil production declined in July 2023, making the country the third largest oil producer in Africa.

In its latest monthly report for August, the global oil cartel said Nigeria’s oil production decreased to 1.081 million barrels per day in July 2023.

According to the report, in June 2023, Nigeria’s oil output, which stood at 1.249 million bpd, surpassed Libya and Angola — making it Africa’s largest producer.

However, the country’s production suffered a huge decline of about 168,000 barrels bdp in the following month, falling two places to the third position.

The PUNCH also observed that Nigeria had no record for the sales of gas from November 2021 to March 2023.

Aside from external borrowings, Nigeria’s major source of forex has been through the sales of crude oil.

However, with the no revenue recorded from this source of forex, Nigeria has been struggling with forex scarcity.

There are indications that the shortage of foreign exchange led to borrowing from other sources to meet up with demand and maintain the external reserves.

According to CBN data on its website, Nigeria’s gross official reserves fell more slowly by $167m month-by-month to around $34.0bn at the end of July 2023, compared to a fall of $975m in June 2023.

The post Naira Slump: CBN Clamps Down On Speculators, Restricts Diaspora Remittances appeared first on Jomog.

Education

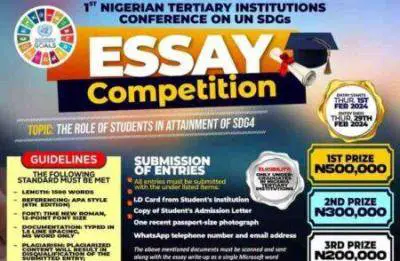

1ST NIGERIAN TERTIARY INSTITUTIONS CONFERENCE ON UN SUSTAINABLE DEVELOPMENT GOALS (SDGS) ESSAY COMPETITION

Competition Overview:

The SDG Youth Essay Competition offers a grand prize of N1 million for the top three winners, along with free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Competition Requirements:

1. Eligibility:

– Open exclusively to undergraduates in Nigerian tertiary institutions.

2. Entry Guidelines:

– Topic:The Role of Students in Attainment of SDG4

– length: Essays should be 1500 words.

– Entry Period: Thursday, February 1, 2024 – Thursday, February 29, 2024

– Referencing: APA Style (6th Edition).

– Font: Times New Roman, 12-point font size.

– Documentation: Typed in 1.5 line spacing, MS Word format only.

– Plagiarism: Only original content is accepted; plagiarized entries will be disqualified.

Benefits:

– Prizes:

– 1st Prize: N500,000

– 2nd Prize: N300,000

– 3rd Prize: N200,000

– Winners will also receive free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Required Documents:

– Student’s Institution ID Card

– Copy of Student’s Admission Letter

– One recent passport-size photograph

– WhatsApp telephone number and email address

Application Procedure:

– All entries and submissions (essay and required documents) should be scanned and sent to nigeriaessay@sdgyouth.org before the deadline.

For Further Inquiries:

– Call: 08068931151, 08133846739, 07067772964

– Email: nigeriaessay@sdgyouth.org

Deadline: February 29th, 2024

Don’t miss this opportunity to contribute to achieving SDG4 and win exciting prizes. Submit your entry and required documents before the deadline. For any inquiries, feel free to contact them via phone or email.

Education

PENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

Competition Overview:

The National Essay Competition invites undergraduate law students to showcase their expertise and contribute to the discourse on AI, privacy, and data protection. In addition to cash prizes, participants have the chance to intern with Pentagon Partners, gaining valuable hands-on experience.

Competition Requirements:

1. Eligibility:

– The competition is open to 400-level and 500-level undergraduate law students in Nigerian universities.

2. Essay Requirements:

– Length: Essays should not exceed 1500 words.

– Format: Double spaced, 12pt Times New Roman font.

– References: OSCOLA format for citations with 10pt font size for footnotes and endnotes.

– Submission Format: Essays must be submitted in PDF format.

– Entrant Details: Include full names, school, level, phone number, and email address in both the body of the email and on the last page of the essay.

– Single Entry: Each entrant is allowed only one submission.

– Originality: Plagiarism will result in automatic disqualification.

Competition Benefits and Timeline:

1. Prizes:

– Winner: N200,000

– 1st Runner Up: N150,000

– 2nd Runner Up: N100,000

2. Internship Opportunity:

– In addition to cash prizes, winners have the exclusive opportunity to intern with Pentagon Partners, enhancing their career prospects.

Application Procedure:

– Interested participants should submit their essays to essay@pentagonpartnerslp.com during the submission period.

– The subject of the email should be the Essay topic

For additional information and updates, visit www.pentagonpartnerslp.com.

Deadline: March 22nd, 2024

Don’t miss this chance to showcase your legal expertise, contribute to important discussions on AI and law, and vie for enticing cash prizes. Pentagon Partners looks forward to receiving your submissions.

Education

SYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

Purpose:

Inaugurated in 2020, the CDEC is part of SystemSpecs’ Corporate Social Responsibility (CSR) commitment to promoting capacity development in the Nigerian ICT industry. By encouraging young Nigerians to tackle everyday issues, the competition contributes to intellectual growth and societal progress.

Topic:

The theme for the 2024 competition is “Protecting the Nigerian Child from the Dangers of Online Technology.” Participants are tasked with exploring strategies to safeguard children in an increasingly digital world.

Eligibility:

– Open to primary and secondary school students in Nigeria aged 9 to 16.

– Junior category (ages 9 to 12) essays must not exceed 1,000 words.

– Senior category (ages 13 to 16) essays must not exceed 1,500 words.

Prizes:

– Winners will receive generous rewards, including a high-capacity laptop, premium headphones, a portable laptop stand, a smart wristwatch, and one year of internet data, among other items.

– Consolation prizes will be awarded to other participants.

Application Process:

– Interested candidates should access the application page

– Essays must be written in English and reflect original thought.

– Each participant is limited to one entry.

– Entries must be endorsed by an accredited school official, parent, or legal guardian.

– Deadline for submissions is April 12, 2024.

Submission Guidelines:

– All submissions must be in PDF format and include the student’s name, home and school addresses, email address, and contact phone number.

– Double entries will result in automatic disqualification.

– Submissions must be received by March 15, 2024, at 5:00 p.m.

Notification of Winners:

– Successful students and schools will be contacted in the second quarter of the year.

– Updates on winners will be announced on @nercng social media platforms.

The SystemSpecs Children’s Day Essay Competition offers a unique opportunity for Nigerian students to demonstrate their creativity and problem-solving skills. By addressing the theme of online child protection, participants contribute to building a safer and more secure digital environment for all. We encourage eligible students to seize this opportunity and showcase their talent and ingenuity.

-

Education8 months ago

Education8 months agoSYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

-

News2 years ago

News2 years agoFull Text of President Bola Tinubu’s Inauguration Speech on May 29, 2023

-

CELEBRITY NEWS2 years ago

CELEBRITY NEWS2 years ago“E no balance”-Netizens react as Bobrisky shows off new shape days after surgery

-

entertainment11 months ago

entertainment11 months agoAuthorities Arrest Six in Connection with Murder of South African Rapper AKA [VIDEO]

-

Education7 months ago

Education7 months agoPENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

-

Education8 months ago

Education8 months agoUNIVERSITY OF LAGOS (UNILAG) ANNOUNCE SALES OF SANDWICH ADMISSION FORM

-

Headlines2 years ago

FULL TEXT: Tinubu Addresses 78th UN General Assembly

-

CELEBRITY NEWS2 years ago

CELEBRITY NEWS2 years ago“I no wan hear anything again o” – Esther Nwachukwu reacts as Chacha Eke and hubby, Austin lock lips in new video