Headlines

TAX RIGHTS AND TAX OBLIGATIONS: TWO SIDES OF THE SAME COIN

It is common knowledge that taxation plays a vital role in the economic development of every country whether developed, developing or under developed, and Nigeria is no exception.

Government at all levels depends on the tax it collects to run the affairs of the State and it is the duty of every taxable citizen to contribute their quota to this effect. Without taxes, there can be no country.

According to the Constitution of the Federal Republic of Nigeria 1999: Section 24 (f) of 1999 Constitution (as amended) it states that “it shall be the duty of every citizen to declare his income honestly to appropriate and lawful agencies and pay his tax promptly”.

This is a legal requirement and it is fundamental to the successful operations of the country. Mind you, it is not an option or a recommendation but an obligation of every Nigerian citizen.

Some Nigerian Tax laws and Regulations which require compliance to tax payment include: Federal Inland Revenue Service (Establishment) Act (FIRSEA), Cap F36 LFN 2007; Personal Income Tax (PITA ), Cap P8, LFN 2004 as amended; Petroleum Profit Tax Act (PPTA), Cap P13, LFN 2004 as amended; Companies Income Tax (CITA), Cap C21, LFN 2004 as amended; Value Added Tax Act (VATA), Cap V1,LFN 2004 as amended; Tertiary Education Trust Fund (Establishment, Etc) Act (TETFEA) 2011 as amended; Stamp Duties Act (SDA), Cap S8, LFN 2004 as amended; Capital Gains Tax Act (CGTA), Cap C1, LFN 2004 as amended; National Information Technology Development Agency Act and the provisions of the Finance Act 2019, 2020, 2021 and 2023. These laws have provided the legal framework containing various tax obligations of a taxpayer.

Every taxpayer has certain rights such as: right to non-discrimination, transparency and accountability, adequate notice and information, redress, compliance assistance amongst others.

But with these rights come responsibilities and obligations that must be fulfilled in compliance with the country’s tax laws. Some taxpayers fall short in fulfilling their tax obligations not necessarily because they want to but for lack or poor understanding of these obligations. This piece aims at shedding light on the key tax obligations of taxpayers in Nigeria.

The obligations of Nigerian taxpayers include, but are not limited to the following: registration for tax: Taxpayers are obligated to register with the appropriate tax authorities, depending on the type of tax they are liable for. This includes obtaining a Taxpayer Identification Number (TIN) from the Federal Inland Revenue Service (FIRS) for companies and the Joint Tax Board (JTB) for individuals.

Another obligation expected of taxpayers is record keeping. Taxpayers are required to maintain accurate and up-to-date records of their financial transactions, including income, expenses, assets, and liabilities. These records are essential for filing tax returns, substantiating deductions, and complying with tax audits. Record keeping is not common practice among small businesses. Yet it is the foundation for fulfilling your tax obligations. If you do not keep your records, how would you know what taxes you are meant to pay?

It is also the obligation of a taxpayers to file tax returns within the prescribed timelines. Individuals are required to file their Personal Income Tax (PIT) returns annually, while companies must file their Corporate Income Tax (CIT) returns within six months after the end of their financial year. Other tax returns, such as VAT returns and WHT returns, may also be required depending on the taxpayer’s activities. All too often, taxpayers think that if they do not make profits, or do not have a turnover above N25 million, then they are not required to file. This is not true. Filing returns is to be made whether or not you made profits or losses. As long as you are a taxpayer, you ought to file returns with the relevant tax authority.

Flowing from this obligation is the obligation to pay taxes—the most commonly spoke about obligation. Taxpayers have an obligation to pay the taxes they owe to the relevant tax authorities. This includes the timely remittance of Personal Income Tax, Companies Income Tax, Value Added Tax, Withholding Tax, and other applicable taxes. They also owe it as an obligation to comply with tax deductions. Employers and businesses that make payments subject to withholding tax (WHT) must deduct the appropriate tax amount at source and remit it to the tax authorities. This includes deducting WHT from salaries, contracts, dividends, interest, and other relevant payments.

Furthermore, taxpayers are required to provide accurate information and documentation as requested by tax authorities. This includes providing supporting documents for deductions, exemptions, and claims made on tax returns as well as cooperating with tax audits and investigations, providing requested information and records, and responding to inquiries in a timely and accurate manner.

To crown it all, taxpayers must comply with all relevant tax laws and regulations which includes staying updated on changes in tax laws and fulfilling their obligations accordingly.

By understanding and diligently leaving up to tax obligations, individuals and businesses actively participate in the development and progress of the country, ensuring a more prosperous, greater and equitable society for all.

Rachel Jantiku, is a researcher and writes from Abuja.

The post TAX RIGHTS AND TAX OBLIGATIONS: TWO SIDES OF THE SAME COIN appeared first on Jomog.

Education

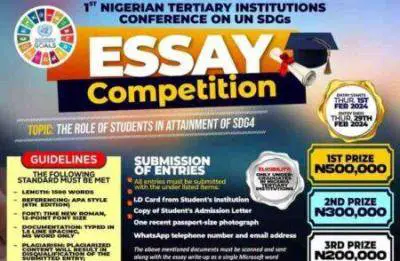

1ST NIGERIAN TERTIARY INSTITUTIONS CONFERENCE ON UN SUSTAINABLE DEVELOPMENT GOALS (SDGS) ESSAY COMPETITION

Competition Overview:

The SDG Youth Essay Competition offers a grand prize of N1 million for the top three winners, along with free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Competition Requirements:

1. Eligibility:

– Open exclusively to undergraduates in Nigerian tertiary institutions.

2. Entry Guidelines:

– Topic:The Role of Students in Attainment of SDG4

– length: Essays should be 1500 words.

– Entry Period: Thursday, February 1, 2024 – Thursday, February 29, 2024

– Referencing: APA Style (6th Edition).

– Font: Times New Roman, 12-point font size.

– Documentation: Typed in 1.5 line spacing, MS Word format only.

– Plagiarism: Only original content is accepted; plagiarized entries will be disqualified.

Benefits:

– Prizes:

– 1st Prize: N500,000

– 2nd Prize: N300,000

– 3rd Prize: N200,000

– Winners will also receive free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Required Documents:

– Student’s Institution ID Card

– Copy of Student’s Admission Letter

– One recent passport-size photograph

– WhatsApp telephone number and email address

Application Procedure:

– All entries and submissions (essay and required documents) should be scanned and sent to nigeriaessay@sdgyouth.org before the deadline.

For Further Inquiries:

– Call: 08068931151, 08133846739, 07067772964

– Email: nigeriaessay@sdgyouth.org

Deadline: February 29th, 2024

Don’t miss this opportunity to contribute to achieving SDG4 and win exciting prizes. Submit your entry and required documents before the deadline. For any inquiries, feel free to contact them via phone or email.

Education

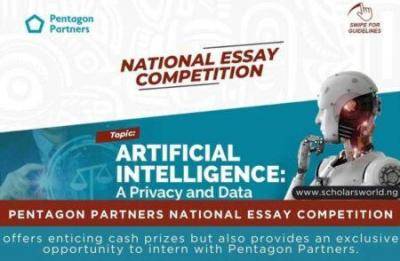

PENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

Competition Overview:

The National Essay Competition invites undergraduate law students to showcase their expertise and contribute to the discourse on AI, privacy, and data protection. In addition to cash prizes, participants have the chance to intern with Pentagon Partners, gaining valuable hands-on experience.

Competition Requirements:

1. Eligibility:

– The competition is open to 400-level and 500-level undergraduate law students in Nigerian universities.

2. Essay Requirements:

– Length: Essays should not exceed 1500 words.

– Format: Double spaced, 12pt Times New Roman font.

– References: OSCOLA format for citations with 10pt font size for footnotes and endnotes.

– Submission Format: Essays must be submitted in PDF format.

– Entrant Details: Include full names, school, level, phone number, and email address in both the body of the email and on the last page of the essay.

– Single Entry: Each entrant is allowed only one submission.

– Originality: Plagiarism will result in automatic disqualification.

Competition Benefits and Timeline:

1. Prizes:

– Winner: N200,000

– 1st Runner Up: N150,000

– 2nd Runner Up: N100,000

2. Internship Opportunity:

– In addition to cash prizes, winners have the exclusive opportunity to intern with Pentagon Partners, enhancing their career prospects.

Application Procedure:

– Interested participants should submit their essays to essay@pentagonpartnerslp.com during the submission period.

– The subject of the email should be the Essay topic

For additional information and updates, visit www.pentagonpartnerslp.com.

Deadline: March 22nd, 2024

Don’t miss this chance to showcase your legal expertise, contribute to important discussions on AI and law, and vie for enticing cash prizes. Pentagon Partners looks forward to receiving your submissions.

Education

SYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

Purpose:

Inaugurated in 2020, the CDEC is part of SystemSpecs’ Corporate Social Responsibility (CSR) commitment to promoting capacity development in the Nigerian ICT industry. By encouraging young Nigerians to tackle everyday issues, the competition contributes to intellectual growth and societal progress.

Topic:

The theme for the 2024 competition is “Protecting the Nigerian Child from the Dangers of Online Technology.” Participants are tasked with exploring strategies to safeguard children in an increasingly digital world.

Eligibility:

– Open to primary and secondary school students in Nigeria aged 9 to 16.

– Junior category (ages 9 to 12) essays must not exceed 1,000 words.

– Senior category (ages 13 to 16) essays must not exceed 1,500 words.

Prizes:

– Winners will receive generous rewards, including a high-capacity laptop, premium headphones, a portable laptop stand, a smart wristwatch, and one year of internet data, among other items.

– Consolation prizes will be awarded to other participants.

Application Process:

– Interested candidates should access the application page

– Essays must be written in English and reflect original thought.

– Each participant is limited to one entry.

– Entries must be endorsed by an accredited school official, parent, or legal guardian.

– Deadline for submissions is April 12, 2024.

Submission Guidelines:

– All submissions must be in PDF format and include the student’s name, home and school addresses, email address, and contact phone number.

– Double entries will result in automatic disqualification.

– Submissions must be received by March 15, 2024, at 5:00 p.m.

Notification of Winners:

– Successful students and schools will be contacted in the second quarter of the year.

– Updates on winners will be announced on @nercng social media platforms.

The SystemSpecs Children’s Day Essay Competition offers a unique opportunity for Nigerian students to demonstrate their creativity and problem-solving skills. By addressing the theme of online child protection, participants contribute to building a safer and more secure digital environment for all. We encourage eligible students to seize this opportunity and showcase their talent and ingenuity.

-

Education8 months ago

Education8 months agoSYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

-

News2 years ago

News2 years agoFull Text of President Bola Tinubu’s Inauguration Speech on May 29, 2023

-

CELEBRITY NEWS2 years ago

CELEBRITY NEWS2 years ago“E no balance”-Netizens react as Bobrisky shows off new shape days after surgery

-

entertainment11 months ago

entertainment11 months agoAuthorities Arrest Six in Connection with Murder of South African Rapper AKA [VIDEO]

-

Education7 months ago

Education7 months agoPENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

-

Education8 months ago

Education8 months agoUNIVERSITY OF LAGOS (UNILAG) ANNOUNCE SALES OF SANDWICH ADMISSION FORM

-

Headlines2 years ago

FULL TEXT: Tinubu Addresses 78th UN General Assembly

-

Headlines2 years ago

Full Text Of President Bola Tinubu’s Address To Nigerians On Socio-economic Challenges