Headlines

NNPC revenue remittance raises fresh questions amid forex crisis

The Nigerian National Petroleum Corporation Limited’s alleged failure to remit enough oil revenues to the federation’s coffers has sparked concerns about the organisation’s transparency. Experts suggest auditing the corporation’s books to enhance transparency and strengthen the naira, DAMILOLA AINA writes

The Nigerian National Petroleum Corporation Limited faced several challenges in the past year which put them in the spotlight for various reasons. They had to deal with fuel scarcity, combat the activities of oil thieves, and shut down illegal refineries in the creeks. It was a difficult year for the corporation.

The issue of non-remittance of revenue into the federation account did not start in 2023. The previous year, Nigeria’s Governors’ Forum accused the corporation of not remitting any revenue into the federal account. Despite a sustained rise in the crude oil price at the international oil market last year, the corporation failed to remit revenue into the federation account. It blamed the payment of subsidy on petrol for its failure to remit revenue into the federal account.

But seven months after the Federal Government ended the subsidy regime, there are still questions about transparency in NNPCL.

President Bola Tinubu announced the removal of fuel subsidies as one of the key policy announcements of his administration during his inaugural speech on May 29, 2023.

Recently, an issue bordering on the low dollar remittance surfaced when a former Governor of the Central Bank of Nigeria, CBN, Sanusi Lamido called for a proper audit of the state oil firm, to unravel the country’s daily oil production, export and the accrued revenue. He carpeted the management of NNPCL for opaqueness in the forex revenue disclosure.

The former Emir of Kano slammed the NNPCL for allegedly failing to remit enough foreign exchange into the government coffers despite the removal of fuel subsidy by the current administration.

He challenged the NNPCL and other agencies to take account of the dollar inflows from its operations amid the rising volatile exchange rate.

He stated, “The exchange rate needs to be stabilised and we have to address the fundamental question: why is there no money coming in? Why is the NNPCL not able to bring in dollars? I am sorry this is the question that cost me my job and I will continue asking this question until NNPCL fixes it up or until I die. Where are the dollars? We need to shine a light on the NNPCL.

“The finance minister cannot tell you because he doesn’t have a monitoring system that reports to him. The finance minister can’t tell you how many barrels of petrol we produce and export. It is only the NNPCL that can give those figures. The finance ministry needs to know how much oil we produce daily, how much we sell, and where the money is going.

“We are no longer paying subsidies, so where are the dollars? It was under recovery during the subsidy era and that has been stopped. So, where is the money? This was the issue I raised for which I was suspended. Well, you can suspend me again. The NNPCL is the most opaque oil company in the world. When I was in the central bank for 15 years, they had not been audited. We have to follow the money from production to export to return. Where is the money going? We paid N11tn in subsidy and there is no accountability up till now. The National Assembly called the NNPCL to bring the documents, but they refused.”

Similarly, the World Bank in its recent Nigeria Development Update noted there was a lack of transparency with the corporation’s management of the fuel subsidy.

It stated that fuel subsidy cost the federation about N380bn a month, and once removed, the federation account should have recorded an increase in net oil revenues.

The bank noted that it extended to subsidy arrears that are still being deducted and the impact of subsidy removal on federation revenues.

According to the World Bank, while revenue gains from the exchange rate reforms are visible; more clarity is needed on oil revenues, including the fiscal benefits from the PMS subsidy reforms.

Its report read, “However, most of the gains in the oil revenues in H2 2023, as reported by OAGF, can be attributed to exchange rate gains. Without exchange rate gains, net oil revenue between January and August would have declined by 0.2 of a percentage point of full-year GDP yoy, all materialising in the July-August period.

“In August, additional revenue from 40 per cent profit of Production Sharing Contracts and the interim yearly dividend were reflected in the accounts. However, these were not as high as what the gains from removing the gasoline subsidy should have been. “Given that petrol pump prices have not changed in line with market fundamentals (notably exchange rate movements and global oil prices), there is a risk that the implicit fuel subsidy has reemerged, potentially keeping net oil revenues lower than expected.”

Pundits believed that the opaqueness had affected the volatility of the foreign exchange market. In 2023, the naira was exchanged for over 1,000/$1 at the Nigerian Autonomous Foreign Exchange market due to a shortage of foreign currency. A surge in forex demand was met with a lower supply, forcing the rate to depreciate by 30 per cent in a day. It has, however, appreciated to 899.10/$1 at the end of 2023.

Similarly, at the parallel market, the local currency also depreciated by 0.58 per cent to close at 1,205/$1 on December 26. It further weakened to 1,210/$1 on the first day of the New Year.

The market continues to grapple with an imbalance created by low forex. Still, Nigeria’s foreign reserves have dipped by 11.3 per cent from $37.08bn on December 28, 2022, to $32.89bn in the same period of last year, according to data obtained from the CBN website.

Reacting, a Professor of Economics at the University of Uyo, Akpan Ekpo, in a telephone interview with NewsNow, noted that calls for improved transparency of the NNPCL were necessary to improve the foreign exchange market.

He said, “The former CBN governor is right to make those calls and auditing the NNPCL is long overdue. They should do it every year because a lot of government revenue in foreign exchange goes through the corporation. So, auditing is needed and is in the right direction. It is to ensure transparency and accountability. I know where the former governor is coming from and they need to do that.

“There is a lot of leakage in terms of the country’s foreign reserves. So, if the auditing is done, everyone will know the quantum of forex that we are losing or that we should have had and that will help the CBN to manage the forex exchange regime very well.”

According to the don, the country cannot operate an open foreign exchange regime; it has to be a managed float.

He argued that it was necessary to audit the NNPC and other government-owned companies that bring in foreign exchange.

“Non-remittance of forex would not affect the CBN plan to a large extent. It could be a marginal impact because we don’t know the quantum yet and even if we didn’t have the NNPC, we would still manage our foreign reserves but knowing what is happening will help. Some countries don’t have NNPC but they manage their foreign reserves,” he added.

For the Chief Executive Officer of the Centre for the Promotion of Private Enterprises, Muda Yusuf, the improved FAAC allocations to the tiers of government indicated that the NNPCL had improved its remittance to the government.

He, however, called on the CBN to release the full details of oil revenue remittances received monthly.

He stated, “We need to be sure that the comment by the former CBN governor is a statement of facts. Those allegations are very weighty and there must be evidence. For so many years, the NNPC has been complaining that revenue from oil exports was spent on subsidies and to import them back into the country for consumption. But now that their commitment to buying petroleum products is reducing, they have been able to remit a lot more. Earnings to the federation account have increased drastically and whatever was given to the CBN will be converted to naira and sent into the federation account.

“The FAAC obviously can’t share remittances in dollars, the money will go to the CBN, where it will be converted at an agreed rate to naira and then shared with all tiers of government.

“So, it is only the current CBN governor who can confirm whether the NNPC is not remitting anything. It is only earnings from an excess crude account that is shared in dollars. The CBN will then use the dollar to support the reserves and that is how you improve the reserves. The concrete evidence we can depend on is if the CBN tells us that the NNPC is not remitting anything and there must be a reason.”

According to the Managing Director/Chief Executive Officer of Cowry Asset Management Limited, Mr Johnson Chukwu, the issue of forex earnings or receipts goes beyond the audit of the NNPCL.

“Well, in the first place, we have to bear in mind that NNPC is playing roles that are beyond that of a private company, which is what it is supposed to be, by borrowing on behalf of the Federal government.

“So, that also means NNPC is still a quasi-federation government entity, given that it is owned by the Ministry of Finance Incorporated and the Ministry of Petroleum. In terms of its receipts, we have to go back and look at the structure, regulation and management of our oil and gas sector and the purchase of accruing revenue into the federation account.

“The audit of crude production and crude export is needed to answer how our crude oil export earnings are received. Are there deductions made at source like under-recovery or are there commitments that have been made for the sale of crude and proceeds of which have been received in advance?” he quizzed.

He remarked that the country’s main challenge remained on crude production, saying, “We have to improve this key figure to get improved dollar revenue because our foreign revenue is limited to our crude production, given that we are still a mono-export product economy.

“So, we still depend on crude production and oil prices remaining elevated. The key thing for us to address is to issue of shortfall in our foreign exchange earnings and improving our crude production in the short term.”

The post NNPC revenue remittance raises fresh questions amid forex crisis appeared first on NewsNow Nigeria.

Education

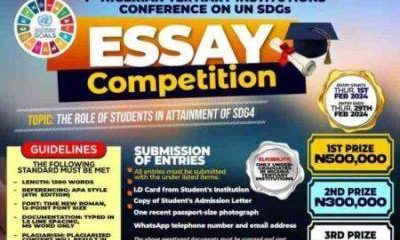

1ST NIGERIAN TERTIARY INSTITUTIONS CONFERENCE ON UN SUSTAINABLE DEVELOPMENT GOALS (SDGS) ESSAY COMPETITION

Competition Overview:

The SDG Youth Essay Competition offers a grand prize of N1 million for the top three winners, along with free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Competition Requirements:

1. Eligibility:

– Open exclusively to undergraduates in Nigerian tertiary institutions.

2. Entry Guidelines:

– Topic:The Role of Students in Attainment of SDG4

– length: Essays should be 1500 words.

– Entry Period: Thursday, February 1, 2024 – Thursday, February 29, 2024

– Referencing: APA Style (6th Edition).

– Font: Times New Roman, 12-point font size.

– Documentation: Typed in 1.5 line spacing, MS Word format only.

– Plagiarism: Only original content is accepted; plagiarized entries will be disqualified.

Benefits:

– Prizes:

– 1st Prize: N500,000

– 2nd Prize: N300,000

– 3rd Prize: N200,000

– Winners will also receive free sponsorship to attend the 1st Nigeria Tertiary Institution Conference on Sustainable Development Goals (SDGs) in April 2024 in Abuja.

Required Documents:

– Student’s Institution ID Card

– Copy of Student’s Admission Letter

– One recent passport-size photograph

– WhatsApp telephone number and email address

Application Procedure:

– All entries and submissions (essay and required documents) should be scanned and sent to nigeriaessay@sdgyouth.org before the deadline.

For Further Inquiries:

– Call: 08068931151, 08133846739, 07067772964

– Email: nigeriaessay@sdgyouth.org

Deadline: February 29th, 2024

Don’t miss this opportunity to contribute to achieving SDG4 and win exciting prizes. Submit your entry and required documents before the deadline. For any inquiries, feel free to contact them via phone or email.

Education

PENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

Competition Overview:

The National Essay Competition invites undergraduate law students to showcase their expertise and contribute to the discourse on AI, privacy, and data protection. In addition to cash prizes, participants have the chance to intern with Pentagon Partners, gaining valuable hands-on experience.

Competition Requirements:

1. Eligibility:

– The competition is open to 400-level and 500-level undergraduate law students in Nigerian universities.

2. Essay Requirements:

– Length: Essays should not exceed 1500 words.

– Format: Double spaced, 12pt Times New Roman font.

– References: OSCOLA format for citations with 10pt font size for footnotes and endnotes.

– Submission Format: Essays must be submitted in PDF format.

– Entrant Details: Include full names, school, level, phone number, and email address in both the body of the email and on the last page of the essay.

– Single Entry: Each entrant is allowed only one submission.

– Originality: Plagiarism will result in automatic disqualification.

Competition Benefits and Timeline:

1. Prizes:

– Winner: N200,000

– 1st Runner Up: N150,000

– 2nd Runner Up: N100,000

2. Internship Opportunity:

– In addition to cash prizes, winners have the exclusive opportunity to intern with Pentagon Partners, enhancing their career prospects.

Application Procedure:

– Interested participants should submit their essays to essay@pentagonpartnerslp.com during the submission period.

– The subject of the email should be the Essay topic

For additional information and updates, visit www.pentagonpartnerslp.com.

Deadline: March 22nd, 2024

Don’t miss this chance to showcase your legal expertise, contribute to important discussions on AI and law, and vie for enticing cash prizes. Pentagon Partners looks forward to receiving your submissions.

Education

SYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

Purpose:

Inaugurated in 2020, the CDEC is part of SystemSpecs’ Corporate Social Responsibility (CSR) commitment to promoting capacity development in the Nigerian ICT industry. By encouraging young Nigerians to tackle everyday issues, the competition contributes to intellectual growth and societal progress.

Topic:

The theme for the 2024 competition is “Protecting the Nigerian Child from the Dangers of Online Technology.” Participants are tasked with exploring strategies to safeguard children in an increasingly digital world.

Eligibility:

– Open to primary and secondary school students in Nigeria aged 9 to 16.

– Junior category (ages 9 to 12) essays must not exceed 1,000 words.

– Senior category (ages 13 to 16) essays must not exceed 1,500 words.

Prizes:

– Winners will receive generous rewards, including a high-capacity laptop, premium headphones, a portable laptop stand, a smart wristwatch, and one year of internet data, among other items.

– Consolation prizes will be awarded to other participants.

Application Process:

– Interested candidates should access the application page

– Essays must be written in English and reflect original thought.

– Each participant is limited to one entry.

– Entries must be endorsed by an accredited school official, parent, or legal guardian.

– Deadline for submissions is April 12, 2024.

Submission Guidelines:

– All submissions must be in PDF format and include the student’s name, home and school addresses, email address, and contact phone number.

– Double entries will result in automatic disqualification.

– Submissions must be received by March 15, 2024, at 5:00 p.m.

Notification of Winners:

– Successful students and schools will be contacted in the second quarter of the year.

– Updates on winners will be announced on @nercng social media platforms.

The SystemSpecs Children’s Day Essay Competition offers a unique opportunity for Nigerian students to demonstrate their creativity and problem-solving skills. By addressing the theme of online child protection, participants contribute to building a safer and more secure digital environment for all. We encourage eligible students to seize this opportunity and showcase their talent and ingenuity.

-

News2 years ago

News2 years agoFull Text of President Bola Tinubu’s Inauguration Speech on May 29, 2023

-

Education6 months ago

Education6 months agoSYSTEMSPECS CHILDREN’S DAY ESSAY COMPETITION (CDEC), 2024

-

CELEBRITY NEWS2 years ago

CELEBRITY NEWS2 years ago“E no balance”-Netizens react as Bobrisky shows off new shape days after surgery

-

Headlines2 years ago

FULL TEXT: Tinubu Addresses 78th UN General Assembly

-

Headlines2 years ago

Full Text Of President Bola Tinubu’s Address To Nigerians On Socio-economic Challenges

-

entertainment9 months ago

entertainment9 months agoAuthorities Arrest Six in Connection with Murder of South African Rapper AKA [VIDEO]

-

Education5 months ago

Education5 months agoPENTAGON PARTNERS NATIONAL ESSAY COMPETITION FOR UNDERGRADUATE LAW STUDENTS

-

Education4 months ago

Education4 months ago1ST NIGERIAN TERTIARY INSTITUTIONS CONFERENCE ON UN SUSTAINABLE DEVELOPMENT GOALS (SDGS) ESSAY COMPETITION